Bagley Risk Management Solutions: Your Guard Versus Unpredictability

Bagley Risk Management Solutions: Your Guard Versus Unpredictability

Blog Article

Exactly How Animals Threat Defense (LRP) Insurance Coverage Can Safeguard Your Livestock Financial Investment

In the realm of animals investments, mitigating threats is critical to ensuring monetary security and growth. Livestock Threat Protection (LRP) insurance coverage stands as a reputable shield versus the uncertain nature of the market, using a strategic method to guarding your assets. By delving right into the intricacies of LRP insurance and its diverse advantages, animals producers can strengthen their financial investments with a layer of security that transcends market changes. As we check out the world of LRP insurance policy, its role in securing livestock financial investments comes to be progressively evident, assuring a path towards sustainable monetary strength in an unstable sector.

Understanding Livestock Risk Defense (LRP) Insurance Coverage

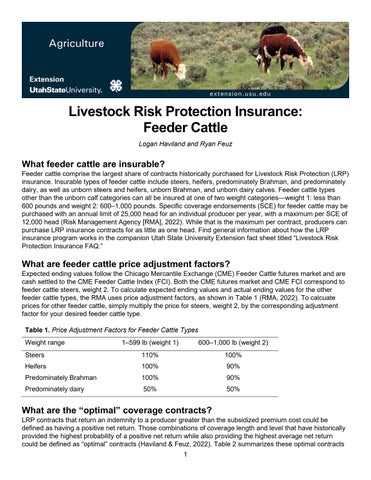

Understanding Livestock Danger Security (LRP) Insurance is important for livestock manufacturers seeking to reduce financial threats related to price changes. LRP is a federally subsidized insurance policy product made to safeguard manufacturers against a decrease in market costs. By providing coverage for market rate declines, LRP aids producers secure a floor cost for their animals, making sure a minimum degree of profits no matter market variations.

One key facet of LRP is its flexibility, enabling producers to personalize coverage degrees and policy lengths to match their specific demands. Producers can choose the variety of head, weight variety, coverage rate, and coverage duration that align with their manufacturing goals and take the chance of tolerance. Comprehending these personalized options is vital for manufacturers to efficiently handle their price threat exposure.

Furthermore, LRP is readily available for numerous livestock kinds, including livestock, swine, and lamb, making it a flexible threat management device for animals producers across different markets. Bagley Risk Management. By acquainting themselves with the details of LRP, producers can make informed decisions to protect their investments and make certain economic security despite market uncertainties

Benefits of LRP Insurance Coverage for Animals Producers

Animals manufacturers leveraging Animals Danger Security (LRP) Insurance policy obtain a strategic advantage in shielding their investments from rate volatility and protecting a secure financial ground among market unpredictabilities. One vital advantage of LRP Insurance policy is cost security. By setting a floor on the rate of their animals, manufacturers can alleviate the danger of significant financial losses in case of market declines. This enables them to prepare their budgets more properly and make educated decisions about their procedures without the continuous worry of price variations.

Furthermore, LRP Insurance policy provides producers with comfort. Knowing that their investments are guarded against unforeseen market modifications permits manufacturers to focus on other facets of their business, such as improving animal wellness and well-being or optimizing production processes. This tranquility of mind can bring about increased productivity and success in the future, as manufacturers can operate with more confidence and stability. In general, the benefits of LRP Insurance coverage for livestock manufacturers are considerable, using a beneficial tool for managing threat and making sure financial safety and security in an unforeseeable market atmosphere.

Exactly How LRP Insurance Mitigates Market Risks

Alleviating market risks, Animals Danger Protection (LRP) Insurance policy offers animals producers with a reputable shield versus price volatility and economic uncertainties. By supplying security versus unforeseen price decreases, LRP Insurance helps manufacturers secure their financial investments and maintain economic stability despite market changes. This sort of insurance coverage permits livestock manufacturers to secure in a cost for their animals at the start of the policy period, making sure a minimum rate level no matter market changes.

Steps to Secure Your Livestock Investment With LRP

In the realm of agricultural danger management, implementing Livestock Threat Defense (LRP) Insurance policy entails a critical procedure to safeguard investments versus market fluctuations and uncertainties. To secure your livestock financial investment properly with LRP, the very first step is to evaluate the particular risks your procedure encounters, such as cost volatility or unexpected climate occasions. Comprehending these risks permits you to figure out the coverage level required to safeguard your investment adequately. Next off, it is vital to research and pick a reliable insurance copyright that uses LRP policies customized to your livestock and service needs. As soon as you have picked a supplier, carefully assess the policy terms, problems, and coverage restrictions to ensure they straighten with your risk monitoring goals. Furthermore, routinely checking market trends and readjusting your coverage as needed can aid optimize your defense against prospective losses. By following these steps diligently, you can enhance the safety of your animals investment and browse market uncertainties with confidence.

Long-Term Financial Safety With LRP Insurance Policy

Making sure withstanding monetary stability through the application of Animals Danger Security (LRP) Insurance is a sensible lasting method for agricultural producers. By including LRP Insurance policy into their risk management strategies, farmers can guard their animals investments against unpredicted market changes and unfavorable events that can threaten their monetary wellness over time.

One trick advantage of LRP Insurance coverage for lasting monetary safety click for info and security is the peace of mind it offers. With a reputable insurance coverage in position, farmers can alleviate the monetary dangers connected with volatile market problems and unforeseen losses due to aspects such as disease episodes or all-natural disasters - Bagley Risk Management. This security allows manufacturers to focus this article on the everyday operations of their animals company without constant fret about possible monetary setbacks

Additionally, LRP Insurance offers an organized method to taking care of danger over the long-term. By setting details protection degrees and choosing proper recommendation periods, farmers can customize their insurance policy plans to line up with their economic goals and run the risk of resistance, making sure a sustainable and safe future for their livestock procedures. To conclude, purchasing LRP Insurance policy is a positive technique for agricultural manufacturers to attain enduring economic safety and security and safeguard their livelihoods.

Final Thought

Finally, Animals Threat Security (LRP) Insurance policy is a beneficial device for animals manufacturers to mitigate market risks and secure their investments. By understanding the benefits of LRP insurance and taking steps to apply it, manufacturers can attain lasting economic protection for their procedures. LRP insurance policy supplies a safety and security internet against price fluctuations and ensures a level of security in an uncertain market atmosphere. It is a smart choice for safeguarding animals financial investments.

Report this page